Mortgage Qualifications

As a Realtor, it’s interesting hear what kind of perceptions people have about mortgage qualifications. What kind of loan can you get? How much do you need to put down? What kind of credit score will allow you to get a mortgage? I work with several mortgage brokers in the DFW area and, as a result, I am exposed to all kinds of mortgage programs that can be leveraged when buying a home. For example, many home buyers do not realize that they no longer need to put 20% down to finance a home. Some loans require 3%, and in some special cases, you can even purchase a home with zero down. What? Yes, you read that right. Other changes that have recently taken place include an increase in loan limits. Fannie Mae and Freddie Mac recently increased its loan limit to $453,100 from $424,100.

Mortgage Qualifications and Your Credit

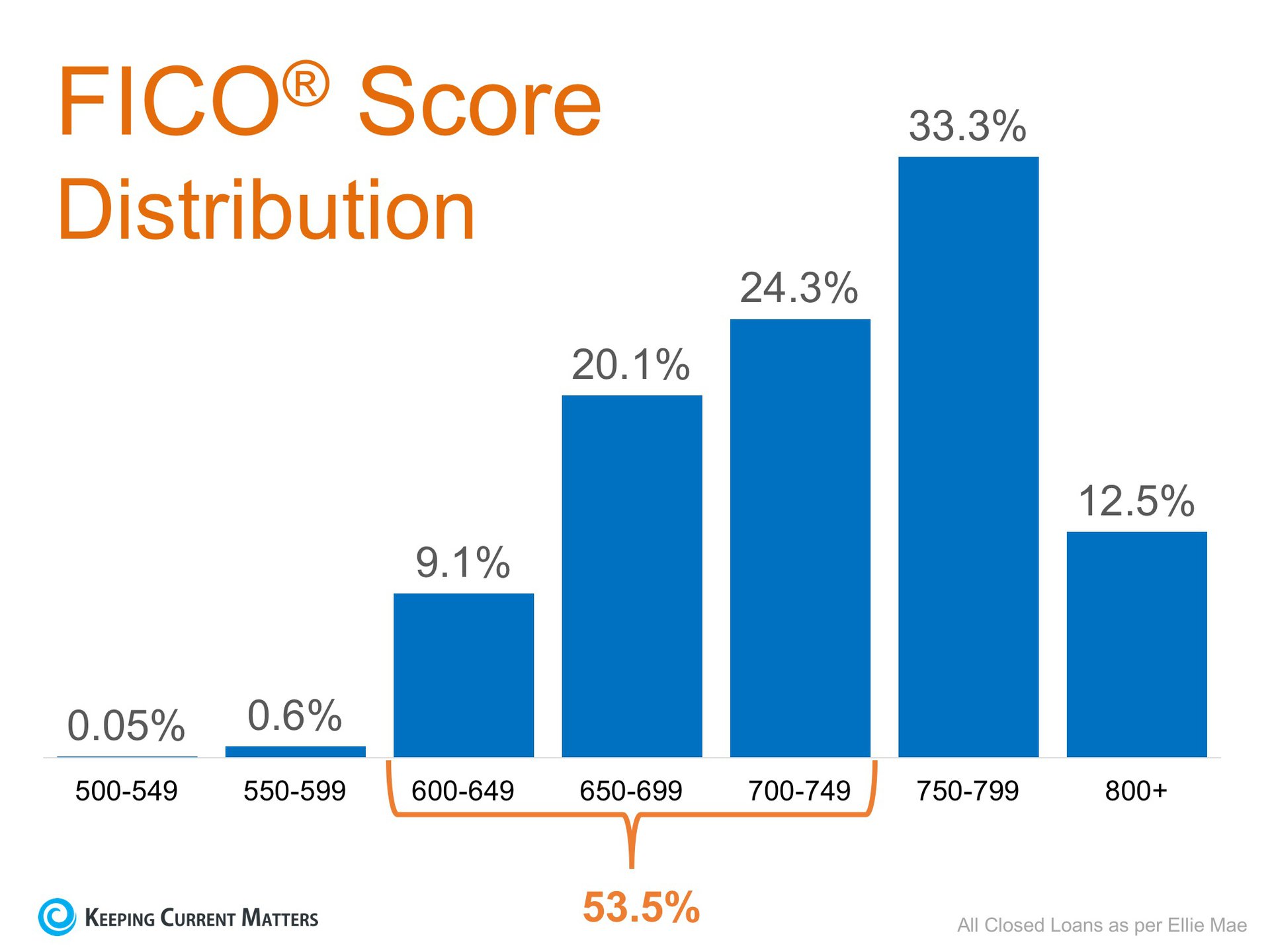

Not only have mortgage qualifications from a down payment and maximum loan amount changed from a few years ago, but we’re seeing shifts in credit scores as well. According to Ellie Mae’s latest Origination Report, the average FICO® Score on all closed loans dropped to 722 which is its lowest mark since April. The average includes all approved refinance and purchase loans.

In fact, as you can see in the chart above, 53.5% of approved mortgages had a credit score of 600-749.

FHA and VA loans showed the most opportunity for millennials looking to enter the market with low down payments and even lower FICO® Score requirements.

Ellie Mae’s Millennial Tracker revealed that those who purchased homes in December with an FHA Loan were able to do so with an average down payment of 4% and a FICO® Score of only 684.

Joe Tyrell, EVP of Corporate Strategy at Ellie Mae commented on the opportunity this brings to buyers,

“With the average credit score dipping, lenders are extending credit to borrowers who may have had no previous access to the housing market.”

Bottom Line

More and more potential buyers are able to qualify for a mortgage loan now! If you are debating a home purchase, meet with a local professional who can evaluate your ability to buy today! If you need suggestions, let me know. I am connected with several lenders who can see what kind of loan you can qualify for.